Table Of Contents

Common Challenges in Digital Reporting

Digital reporting presents several challenges that organisations must navigate. One of the main issues is the integration of disparate data sources. Businesses often collect data from various platforms, such as customer relationship management systems, social media, and financial tools. Combining this information into a cohesive reporting framework can be complex. Inadequate data consistency may lead to discrepancies, compromising the quality of analytics and reporting.

Another significant challenge lies in ensuring the accuracy and timeliness of reports. In a rapidly changing business environment, relying on outdated information can hinder decision-making. Furthermore, maintaining compliance with industry regulations adds another layer of complexity. Companies must ensure that their reporting processes are secure and align with data protection laws. These challenges create a significant burden for teams tasked with delivering reliable analytics and reporting, emphasising the need for robust strategies and tools.

Overcoming Data Integration Issues

Data integration issues often emerge from disparate systems that do not communicate effectively. Organisations frequently grapple with data residing in silos, leading to incomplete or inconsistent information. To address these challenges, employing robust data management strategies is crucial. Standardising data formats and establishing clear data governance protocols can facilitate smoother integration. Companies should also consider leveraging middleware solutions that enable different systems to work together seamlessly. This enhances the reliability of Analytics and Reporting processes.

Another approach to overcoming data integration challenges lies in adopting cloud-based solutions. These platforms often provide greater flexibility and scalability, allowing organisations to integrate various data sources more effectively. Through APIs, companies can connect different applications, which simplifies the data aggregation process. By ensuring that all relevant data flows into a centralised platform, analytics capabilities improve significantly, paving the way for more accurate and timely reporting. Investing in up-to-date technology plays a key role in refining Analytics and Reporting efforts while mitigating potential integration hurdles.

Best Practices for Digital Reporting

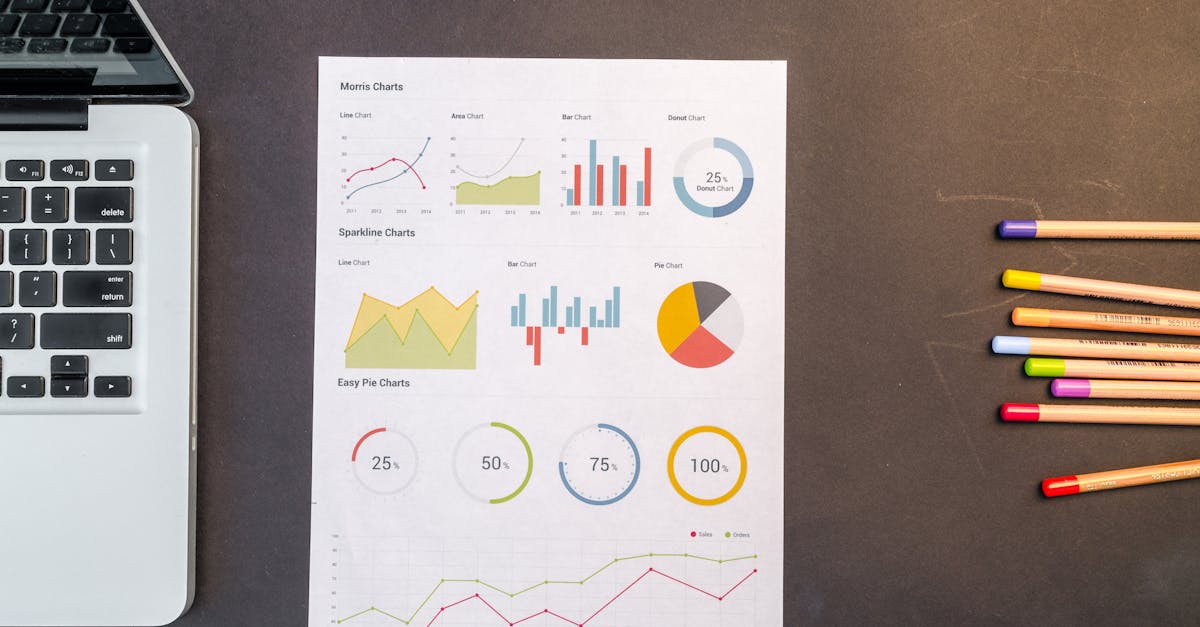

Implementing a structured approach to Analytics and Reporting is crucial for achieving meaningful insights. Establishing clear objectives at the outset helps in tailoring reports that address specific business needs. Consistent formatting and visualisation techniques aid in enhancing readability. Teams should prioritise data accuracy, using reliable sources to minimise errors. Regularly updating reporting templates keeps them relevant and effective, ensuring that stakeholders receive the most current information.

Collaboration between departments enhances the quality of Analytics and Reporting. Involving stakeholders from various areas fosters a broader perspective on data interpretation. Regular training sessions for staff can improve their proficiency in reporting tools and data analysis methods. Encouraging feedback on reports helps in refining content and presentation. By embracing these best practices, organisations can transform their reporting processes into valuable decision-making assets.

Ensuring Compliance and Security

Ensuring compliance and security in digital reporting is critical for businesses to protect sensitive data and maintain trust with stakeholders. Companies must be aware of relevant regulations, such as the General Data Protection Regulation (GDPR) and the Australian Privacy Principles (APPs). Adhering to these rules not only safeguards customer information but also helps in avoiding significant fines and reputational damage. Implementing robust data governance practices is essential. This covers establishing clear policies around data access, usage, and sharing, alongside continuous monitoring to identify potential breaches.

Analytics and reporting play a key role in achieving compliance and security. Leveraging advanced analytical tools can enhance the ability to track data flow and ensure regulatory requirements are met. Businesses should integrate security measures into their reporting processes, employing encryption and access controls. Regular audits and assessments further strengthen these efforts, fostering a proactive stance against risks. By focusing on both compliance and security, organisations can ensure that their digital reporting practices are both effective and trustworthy.

Future Trends in Digital Reporting

Emerging technologies are reshaping the landscape of digital reporting. Businesses are increasingly relying on advanced analytics and reporting tools to gain deeper insights from their data. This shift allows companies to not only track their performance but also forecast future trends with greater accuracy. The integration of real-time data and artificial intelligence enhances decision-making processes, enabling organisations to respond swiftly to market changes.

As the demand for data-driven decision-making grows, so does the need for more sophisticated visualisation techniques in analytics and reporting. Enhanced user interfaces and interactive dashboards will become standard, making complex data easier to comprehend. Furthermore, the emphasis on storytelling through data is likely to strengthen, helping stakeholders engage with insights on a deeper level. This trend toward clarity and engagement will be vital for businesses aiming to maintain a competitive edge in a rapidly evolving digital landscape.

The Role of Automation and AI

Automation and artificial intelligence (AI) are revolutionising the landscape of digital reporting, streamlining processes that once consumed significant time and resources. By automating data collection and analysis, organisations can produce real-time insights far more efficiently. This transformation enhances the accuracy and consistency of data, allowing businesses to focus on interpreting results rather than getting bogged down in manual tasks. Analytics and reporting emerge as crucial components, helping teams to quickly identify trends and anomalies that may require attention.

As AI technologies become more sophisticated, predictive analytics will play an increasingly vital role in shaping decision-making. By leveraging machine learning algorithms, organisations can forecast future performance based on historical data, leading to more informed strategic planning. The integration of these technologies into analytics and reporting frameworks not only enhances the value of the data but also empowers teams to act proactively rather than reactively. This shift promises to deliver a competitive edge in a rapidly evolving marketplace.

FAQS

What is digital reporting?

Digital reporting refers to the process of collecting, analysing, and presenting data in a digital format, enabling organisations to communicate their performance, insights, and findings effectively.

What are some common challenges in digital reporting?

Common challenges include data integration issues, ensuring accuracy and consistency of data, compliance with regulations, and managing security risks associated with digital platforms.

How can organisations overcome data integration issues in digital reporting?

Organisations can overcome data integration issues by implementing data management tools, ensuring standardised data formats, and fostering collaboration between departments to streamline data collection processes.

What best practices should be followed for effective digital reporting?

Best practices include setting clear objectives, ensuring data accuracy, maintaining visual clarity in reports, regularly updating content, and adhering to compliance and security standards.

What future trends are expected in digital reporting?

Future trends include increased use of automation and AI to enhance data analysis, improved visualisation techniques, real-time reporting capabilities, and greater emphasis on data security and compliance.